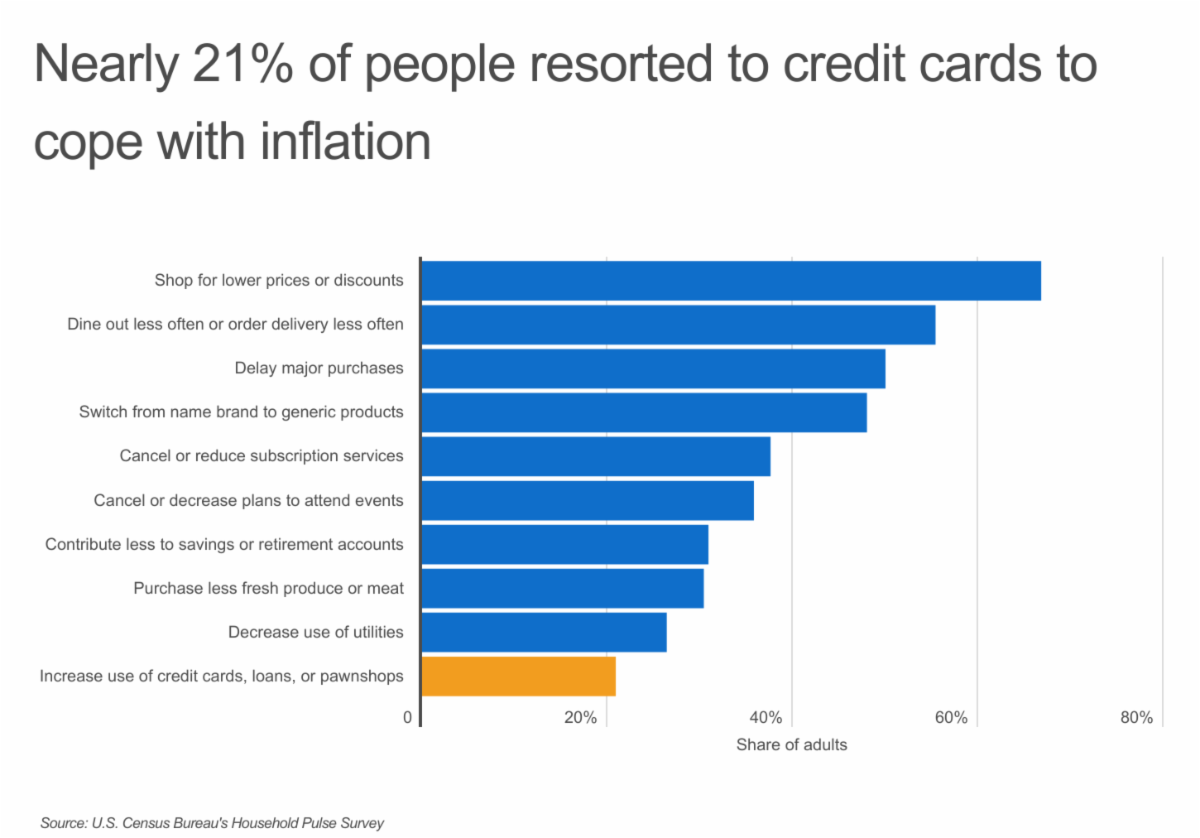

Consumers are adopting a variety of strategies to cope with the effects of inflation. Most commonly, shoppers look to cut costs: more than two-thirds of adults say they look for lower prices or discounts when making a purchase, more than half are eating out less and delaying major purchases, and nearly half are switching from name brand to generic products.

Inflation has also pushed 21% of adults to use credit cards, loans, or pawnshops to help pay their increased costs. Reliance on credit can be a quick way to help make ends meet in the short term, but doing so can be a risky move financially. People who carry balances on their credit cards or pay off loans slowly will ultimately pay more in interest—a risk exacerbated by the fact that interest rates have risen dramatically.

U.S. households are not turning to credit cards in equal measure, however, as there are geographic differences in where adults have started using cards more frequently. States in the Midwest, like Wisconsin and South Dakota, and in the South, like Georgia and Mississippi, have the fewest adults reporting an increased reliance on credit cards to cope with inflation. In contrast, Western states like Utah, Arizona, Nevada, and California have all seen nearly one in four adults using their cards more often. But one New England state—Maine—sits at the top of the list, with 24.6% of adults reporting an increased reliance on credit cards due to rising prices.

To find the states where inflation is driving increased reliance on credit cards, researchers at Upgraded Points analyzed data collected in early January 2023 from the U.S. Census Bureau’s Census Household Pulse Survey. Researchers ranked states according to each state’s share of adults that increased their use of credit cards, loans, or pawn shops to cope with price increases.

The analysis found that 34.4% of adults in Georgia relied on credit cards to meet their spending needs, and 16.9% have increased their credit card usage due to recent price increases. Here is a summary of the data for Georgia:

-

Share of adults that increased their use of credit cards due to prices: 16.9%

-

Share of adults that relied on credit cards to meet spending needs: 34.4%

-

Share of adults stressed about recent price increases: 94.7%

-

Share of adults concerned about future price increases: 95.1%

For reference, here are the statistics for the entire United States:

-

Share of adults that increased their use of credit cards due to prices: 20.9%

-

Share of adults that relied on credit cards to meet spending needs: 37.3%

-

Share of adults stressed about recent price increases: 94.4%

-

Share of adults concerned about future price increases: 95.8%

For more information, a detailed methodology, and complete results, you can find the original report on Upgraded Points’s website: https://upgradedpoints.com/credit-cards/inflation-related-credit-card-use-by-state/

|